AEC Blueprint 2025 Analysis: Paper 3 | Liberalisation of the Trade in Services

by Ken Li Yee | Originally published on 3 March 2016.

Summary

The AFAS helped to pave the way for commitments towards liberalising the trade in services. However, not all of these commitments have translated to concrete policy change, and with the introduction of ATISA, will the AEC Blueprint 2025 be able to right ASEAN’s path?

Foreword

The AEC Blueprint Analysis series is a publication which seeks to provide insight into the ASEAN Economic Community Blueprint (AEC) 2025. The publication will seek to do so by adopting a holistic approach in its analysis; creating context by examining past achievements, defining present challenges, and discussing future plans. The series will pay special attention to strategic measures outlined within the AEC’s new blueprint, providing insights with regards to the viability of regional economic integration under the AEC.

A. Past Plans

What were the targets in the AEC 2015 Blueprint?

The goal of free flow of goods was a key element in achieving the AEC’s first pillar within the 2015 blueprint, which detailed the creation of a single market and production base. As the World Trade Organisation’s (WTO) General Agreement on Trade in Services (GATS) covers a significant portion of liberalising the trade in services, ASEAN’s focus has primarily been centred on addressing issues not covered by the treaty; this is known as the GATS-Plus principle. (Secretariat, 2015) Since the formation of ASEAN in 1967, several agreements and plans have been put in motion:

1. General Agreement on Trade in Services (GATS)

GATS defined the four main modes of supply for the delivery of services so as to simplify discussions regarding the subject. It should be noted that services liberalisation will be discussed in terms of the GATS classification of service delivery modes:

- Mode 1: Cross-border supply – Service deliveries between entities in different states (e.g. sale of data).

- Mode 2: Consumption abroad – Service deliveries to a service consumer in another territory (e.g. tourism).

- Mode 3: Commercial Presence – Services provided in a member state by a foreign-owned supplier (e.g. FDI).

- Mode 4: Presence of a natural person – Services provided by a natural person in the territory of another country (e.g. foreign consultants).

2. ASEAN Framework Agreement on Services (AFAS)

Signed in 1995, the AFAS detailed broad guidelines concerning improving market access and standardising national treatment for services suppliers amongst member states.

- In 2003, the Protocol to Amend the AFAS was signed, introducing the “ASEAN Minus X” implementation method. This meant that countries not ready to partake in certain economic schemes were able to opt out

- The AFAS can be viewed as a modular agreement, with consecutive packages of commitments signed into agreement following rounds of negotiation by the ASEAN Economic Ministers (AEM); whilst the 9th package of the AFAS is the latest package in effect, the 10th AFAS package has been finalised and will be ratified in the short term future.

without halting the progress of services liberalisation for other member states.

3. The AEC Blueprint 2015

Adopted in 2007, the blueprint defined the commitments and priority sectors which would be the focus of negotiations.

- A timeline was adopted, with commitment packages to be finalised every two years.

- The blueprint also called for ancillary actions to be taken in support of services liberalisation, such as the completion of MRAs.

B. Past Achievements

What has been achieved?

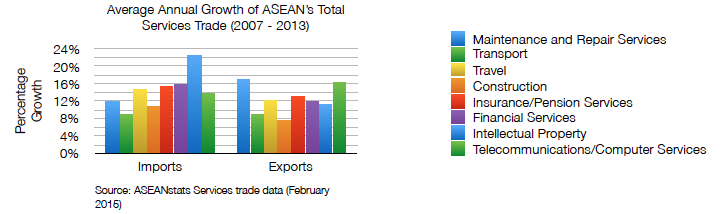

As illustrated by the graph above, the average annual growth of total services trade of ASEAN member states over the period 2007-2013 has been strong. In particular, the growth in intellectual property imports and exports in maintenance and repair services is apparent. Growth in the trade of services has been encouraged by the increasing scope and coverage of AFAS’ package commitments, as illustrated in the figures below:

- The number of service subsectors targeted by the 9th and latest AFAS package has been increased to 104.

- The removal of foreign ownership restrictions and lowering of trade barriers has increased in scope as illustrated by the rise in minimum ASEAN equity participation and liberalisation measures.

According to GATS classification, the AFAS has been primarily successful in addressing service liberalisation in Modes 1 and 2, as illustrated by the AFAS’ complete removal commitment. Mode 4 has seen moderate progress with the finalisation of certain MRAs, whilst Mode 3 has improved under increasing minimum ASEAN equity participation requirements. Under the AFAS and AEC Blueprint 2015, ASEAN has concluded:

- Nine packages of general commitments.

- Two additional packages of commitments concerning Financial Services.

- Three further packages of commitments pertaining to Air-Transport Services.

- Seven MRAs have been finalised covering various sectors for both trade in goods and services.

ASEAN commitments have increased with time in terms of both number and depth, with policy change occurring

across the development spectrum. (Dee 2015)

C. Present Challenges

What are the current issues?

A comparison between services trade commitments with actual domestic policies in each of the ASEAN member states done by the ERIA found that there was a significant lag between AFAS commitments and the implementation of domestic policy change. (Dee, 2015)

This is reflected in the table to the right, where sectors with negative correlation indicate rising scorecard liberalisation and falling trade barriers in those sectors; on the other hand, positive correlations showcase sectors where whilst scorecard liberalisation rates are increasing, the barriers to trade are also increasing.

Although an increase in country scorecard liberalisation rates should directly result in the national decrease of trade barriers, this is apparently not the case. Instead, correlations between scorecard liberalisation rates and trade barriers in most sectors are either weak or even positive. This means that commitments are not being translated into policy change.

AFAS initiated liberalisation is currently relatively marginal compared to GATS commitments. (Deunden, 2012)

Mode 3 liberalisation only increases the minimum foreign ownership threshold to a 70% ASEAN equity share.

Mode 4 liberalisation is confined to the movement of professionals only.

D. Future Plans

What new measures are included in the AEC 2025 Blueprint?

The AEC 2025 Blueprint seeks to replace an aging AFAS with the ASEAN Trade in Services Agreement. (ATISA)

Several new supplementary initiatives have been brought to the table, in particular, the call for common definitions with regards to sensitive lists and sectors.

A key component of focus will be the ongoing review of the “ASEAN minus x” commitment system, with the majority of ASEAN states hoping to lower the level of flexibility offered so as to advance a unified free trade agenda.

E. AEC 2025 Blueprint Analysis

What do the measures entail?

F. Conclusion

What does the AEC 2025 Blueprint mean in terms of Trade in Services?

It is unclear at this point what the ATISA will bring to the table in concrete terms, however, the significant issue of domestic legislation change lagging behind commitments is unlikely to be directly addressed by the new legal instrument.

Instead, the development of initiatives fostering economic growth will continue to push the liberalisation of services. This is evidenced by the positive correlation between trade in services liberalisation and economic growth, which is best seen in the case of Vietnam and its rush of foreign ownership liberalisation and simultaneous economic boom, where FDI attracted by more liberal laws has spurred growth.

The most significant change indicated by the AEC Blueprint 2025 would be the fact that it hints that several key mechanisms under the AFAS will be reviewed, such as but not limited to:

- The ASEAN Minus x commitment system.

- Defining sensitive sectors and legitimate public policy concerns.

References

ASEAN 2025: Forging Ahead Together, The ASEAN Secretariat (2015).

Chia, S.Y. 2013. The ASEAN Economic Community: Progress, Challenges, and Prospects. ADBI Working Paper 440. Tokyo: Asian Development Bank Institute.

Dee, P. (2015). Monitoring the Implementation of Services Trade Reform towards an ASEAN Economic Community.

Deunden, N. 2012. An Assessment of the Implementation of AEC Service Liberalisation Milestones. Paper presented at the ASEAN Roundtable 2012 on Examining the ASEAN Economic Community Scorecard. ISEAS.

May 2012.

Dinh, H. (2013), ‘Impact of Regulatory Barriers to Trade in Banking Services’, in P. Dee (ed.), Priorities and Pathways in Services Reform: Part 1—Quantitative Studies, World Scientific Studies in International Economics 26. Singapore: World Scientific, pp.67–109.

Secretariat, T. A. (2008). ASEAN Economic Blueprint.

Secretariat, T. A. (2015). ASEAN Integration Report 2015.

Secretariat, T. A., & UNCTAD. (2015). ASEAN Investment Report 2015 Infrastructure Investment and Connectivity.

Secretariat, T. A. (2015). A Blueprint for Growth ASEAN Economic Community 2015: Progress and Key Achievements.