Singapore: Budget FY2018 – Playing the long game

Originally published by CIMB Research and Economics on 20 February 2018.

HIGHLIGHTS

Budget FY2018: Playing the long game

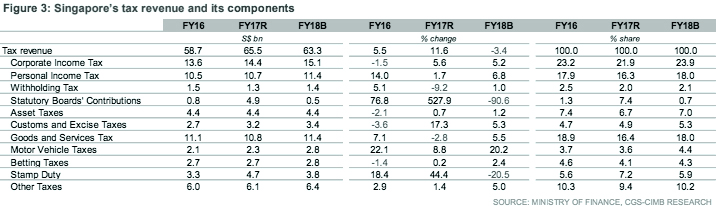

- A widely anticipated GST hike is likely to occur sometime in 2021-25, which would lift the rate by 2% pt, from 7% currently to 9%, yielding revenue of 0.7% of GDP.

- Other tax changes include GST on imported services, carbon taxes of S$5/tonne, 1% hike in the top rate for homebuyer stamp duty and a 10% rise in tobacco excise duty.

- Additional social safety net enhancements offered to households to cope with higher living costs, elderly, healthcare, education, as well as a one-off S$100-300 ‘hongbao’.

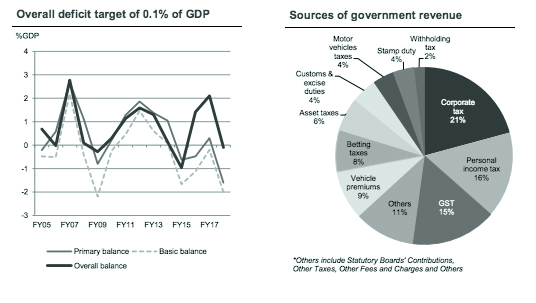

- The juggling act between phased-in tax hikes and rising government spending keeps fiscal sustainability intact with an overall deficit target of 0.1% of GDP.

Creating bandwidth to tackle long-term structural challenges

Singapore’s Budget FY2018 has sought to expand measures to address longstanding challenges that include “future-proofing” the economy, a rapidly-ageing population and ensuring fiscal sustainability. The government said it has sufficient resources to meet planned spending until 2020, and hence, the announcement of pre-emptive steps to bridge the growing gap in spending needs was made with the next decade in mind.

2% hike in GST proposed for ‘sometime’ in 2021-2025

Subject to prevailing economic conditions, the government has proposed to raise the goods and services tax (GST) progressively by 2% sometime in the earlier part of 2021 to 2025, which skirts around the next election due in Jan 2021. This would be the first GST hike since 2007, when the rate was increased from 5% to 7%, and adds 0.7% of GDP annually to the fiscal coffers. Mitigating measures include: 1) absorption of GST on public healthcare and education, 2) top up of GST voucher fund, and 3) a GST offset package.

Taxes shape incentives on the environment, equitability and health

The Budget Speech revealed details of a S$5/tonne carbon tax on facilities with emissions exceeding 25,000 tonnes in 2019 to 2023, after which the rate is up for review, with an end target of S$10-15/tonne by 2030. To expand the tax base and level the playing field, the government imposed GST on imported services effective 1 Jan 2020, though these exclude e-commerce. In a nod to progressive taxation, the government will raise the top marginal Buyers Stamp Duty, which applies to residential properties above S$1m, from 3% to 4%. Lastly, the government raised the tobacco excise duty by 10%.

Financing an ageing population and infrastructure upgrades

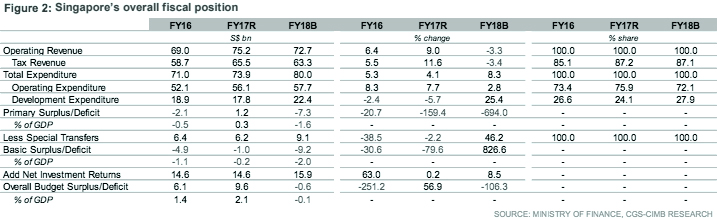

The demographic shift to an ageing population is increasing the strains on public spending, the government said. Predictably, Budget FY2018 devoted ample resources to helping households cope with the costs associated with elderly care, healthcare and education. A higher-than-estimated budget surplus of S$9.6bn in FY2017 (vs. forecast of S$1.91bn) also allowed the government to set aside funds for rail infrastructure (S$5bn), health subsidies (S$2bn) and dole out a one-off SG Bonus of S$100 to S$300 to Singaporeans aged above 21 tiered by accessible income in YA2017 totaling S$700m.

Future-proofing Singapore…

Talk of the future was not limited to life, death and taxes, as Budget FY2018 also ruminated on themes from recent Budgets centered on establishing a vibrant and innovative economy. Policies included extensions of the Wage Credit Scheme, the corporate income tax rebate, the Career Trial Scheme, Productivity Solutions Grant, tax deductions on licensing payments and R&D, and were particularly targeted at SMEs.

… without breaking the bank

Officials expect the economy to grow 1.5-3.5% in 2018 (+3.6% in 2017), with operating revenue projected to fall 3.3% to S$72.7bn against total spending of S$80.0bn (+8.3%), yielding a primary deficit of S$7.3bn or 1.6% of GDP. After factoring in NIR and Special Transfers, Singapore’s budget deficit is estimated at S$0.6bn or 0.1% of GDP in 2018. To maintain prudence, the government will also cap the growth in ministries’ block budgets to 0.3x of GDP growth in FY2019 from 0.4x in FY2018.