LIFTING-THE-BARRIERS REPORT 2015 | HEALTHCARE

Published date: August 2015

TABLE OF CONTENT

(Click any topic to read the related section)

- 1. ASEAN – The Growth Story

- 2. AEC – Quest for One Market Representing All Of ASEAN

- 3. Challenges Along The Way

- 4. Lifting The Barriers – Paving The Way Forward

- 5. Post LTB Considerations

1. ASEAN – THE GROWTH STORY

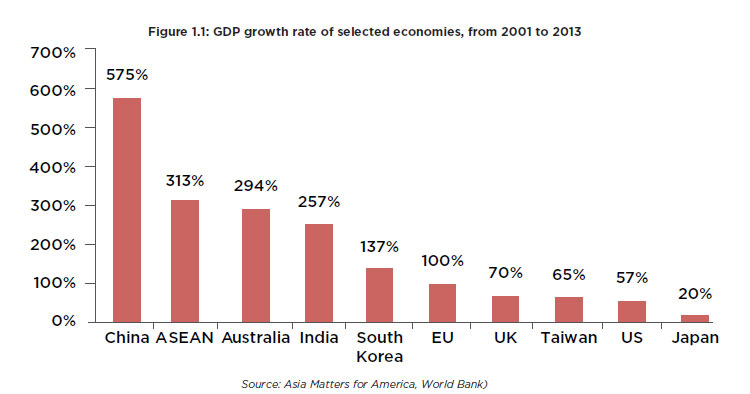

ASEAN has the second highest GDP growth rate in the world (See Figure 1.1). The size of the economy of ASEAN has more than quadrupled since 2001.

ASEAN’s healthcare expenditure is estimated to be slightly below Australia, but ahead of India.

The growth opportunities of the healthcare sector are huge as the ASEAN nations consist primarily of emerging markets, with over 600 million people.

ASEAN is slowly evolving into a manufacturing base for low cost manufacturing of generic drugs and medical devices. ASEAN’s natural resources and diversity in flora and fauna provides a unique environment that encourages production and research.

Other than natural market growth, government policy will be a major driver for the ASEAN market to develop further. Majority of the ASEAN Technical Submission Common Dossier has already been agreed and conformed to, for both pharmaceuticals and medical devices. The ASEAN Economic Community (AEC) launching on 31 December 2015 will see gradual impacts on the manufacturing and distribution markets, with significant impact on trade of services.

2. AEC – QUEST FOR ONE MARKET REPRESENTING ALL OF ASEAN

2.1 The AEC aims to initiate a single market with reducing barriers to trade through a non-binding agreements framework. The comprehensive framework works in sync with open skies as well as Mutual Recognition Agreements (MRAs) for standardised qualifications. With this, ASEAN will be able to tap into the potential of liberalising trade of pharmaceutical and medical products and services, as well as the flow of skilled labour such as physicians, medical technicians and nurses. This can change purchasing patterns to regional transactions, as well as remove barriers for services from other countries to help support lacking domestic services in a particular ASEAN country.

In healthcare, AEC will impact ASEAN by fostering understanding for member nations’ trade perspectives. It addresses the regulations to assist in the accessibility into new or existing markets, enable more competitive manufacturing and allowing ASEAN to tap into its large demographics.

The AEC will impact the healthcare sector of ASEAN through three main channels:

i. Increasing Intra-ASEAN Trade And Investment

• Tariff elimination

• Decrease of non-Tariff measures

• Standards and conformance

• Logistic service improvement

• Investment and financial infrastructure

ii. Technological Capabilities

• A standardised health services in technology and understanding

• Interconnected health database across nations

• E-Learning and Training

iii. Improving Human Resources Capability + Licensing

• Trade in services of medical technologists

• Trade in nursing services

• Trade in doctoring services

• Training and skills certification

• Language barrier and certification

• Licensing harmonisation

3. CHALLENGES ALONG THE WAY

As a region with varying cultures, economic development, languages, political systems, the harmonisation of standards and mutual recognition of certification will allow for procedure and practice streamlining. Healthcare expenditure per capita remains far below the global average in most countries despite the double digit growth in total healthcare expenditure.

3.1 Harmonisation of Qualifications and Standards

The Pharmaceutical Product Working Group and Medical Device Product Working Group have been contributing to the development of the ASEAN Common Technical Dossier. The Product Working Group for Traditional Medicines and Health Supplements contributes towards the traditional medicine market. While the processes in each country include compliance to the Technical Dossier, it does not address the protectionism of one’s own market. Although governments are ready to test their domestic products against international standards, not many are ready to remove all barriers to trade.

The flow of medical staff will be limited due to regional qualifications which are bound by language boundaries. The risk of misunderstandings during treatment limits services that can be shared.

Varying education standards will result in a varying skill base, which the divide will limit trade of services.

3.2 Tax And Law Structure

Each country still has its own tax structure that it imposes on manufacturers, distributors and the medical professionals. Intra-ASEAN national disputes will provide additional concerns for the legal sector for standardising a highly regulated market such as healthcare. To add to this, national sociocultural protection imposing limited share ownership by non-local industry stakeholders exist in ASEAN.

3.3 Economic Issues

Wide disparities exist between member countries especially in terms of quality, accessibility and affordability. This reflects in differing environment which impose higher risk for certain business investments. Local industry will be impacted due to increased competition for local players as the market becomes more open.

4. LIFTING THE BARRIERS – PAVING THE WAY FORWARD

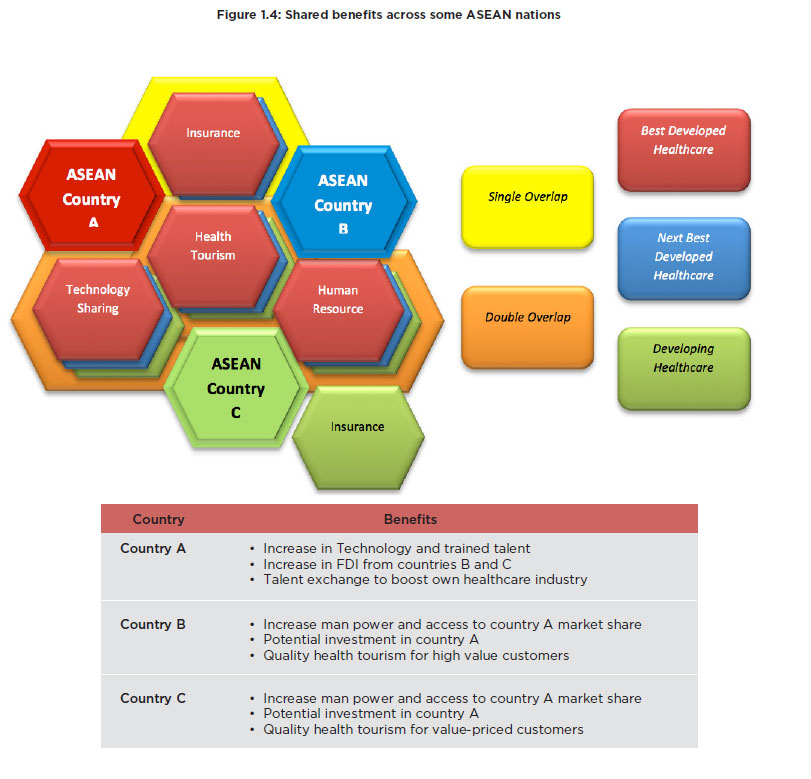

Despite the challenges in the healthcare industry, the outlook still presents opportunities to move forward. The integration of ASEAN involves both the policy makers and the healthcare business community. Benefits and shared capabilities spur economic activity within the region, where markets are similarly developed. The next step will be to enable the less developed nations to participate accordingly.

Some of the ASEAN nations have multiple shared sectors or established relations to each other. Human resource sharing includes employment of other ASEAN nationalities in another country. A full integration of the AEC will see total integration of the above figure 1.4 inclusive of insurance in all the ASEAN member nations.

4.1 Health Tourism

Travel and tourism will enable more exchange and business opportunities to thrive. Private healthcare spending is higher among the ASEAN nations with the exception of Brunei, Thailand and Malaysia, with the latter of marginal difference. Further opportunities arise for: • Increasing market coverage across ASEAN.

• Branding specialisation across border.

• Partnership with the travel and hospitality industries.

Differences in the level of healthcare delivery in the ASEAN countries provide opportunities in health tourism for those countries with better healthcare facilities and talents.

4.2 ASEAN Insurance

Insurance companies can extend their policies to cover healthcare fees across the ASEAN region as another step towards ASEAN integration. As in figure 1.4, insurance shared claims are possible in between certain countries, but are no possible in others. By combining the ASEAN countries, an ASEAN wide insurance coverage will have a market of over 615.7 million people.

Additional health and wealth opportunities for insurance across ASEAN will provide better outlook for policy holders. Investment-linked health insurance may also provide regional development investment opportunities from selected emerging economies. The roundtable participants view ASEAN integration of insurance is important to fuel health tourism, as well as support talent mobility.

4.3 Human Resource

4.3.1 Talent Development

The healthcare industry in ASEAN faces talent shortages. However these shortages are unique to each country. The workforce in ASEAN healthcare requires:

- More effective talent distribution among the member nations is required in ASEAN healthcare.

- Recognised ASEAN education accreditation standards across ASEAN government that meets the expectations of both private and public practice.

- Adaptable talent to the different ASEAN countries’ language and culture.

4.3.2 Mobility

Talent exchange among the ASEAN nations will help solve the lack of talent in certain countries. Although language barrier still limits certain countries such as Thailand, many hospital groups in ASEAN share little roles apart from management and purchasing across borders.

Exchange of support services, with centralisation of laboratories among the healthcare providers in specific countries may save on cost and provide learning benefits.

Exchange by supply of manpower, such general practitioners in Indonesia from Malaysia, while helping solve the shortage of specialists in Malaysia by facilitating specialist services from the Philippines.

4.4 Technology Development

ASEAN countries are open towards new technology, reflected in the policies for technology, healthcare, robotics and IT. Basic health coverage on the other hand still requires development, partly due to the geography, manpower and rural development rate.

The industrial policies governing technology in ASEAN allows access to robotics and Healthcare-IT, allowing a more holistic healthcare development and entry. However, in the emerging economy of varying levels of development in ASEAN, expansion of basic healthcare is still the priority.

4.5 Aging Society

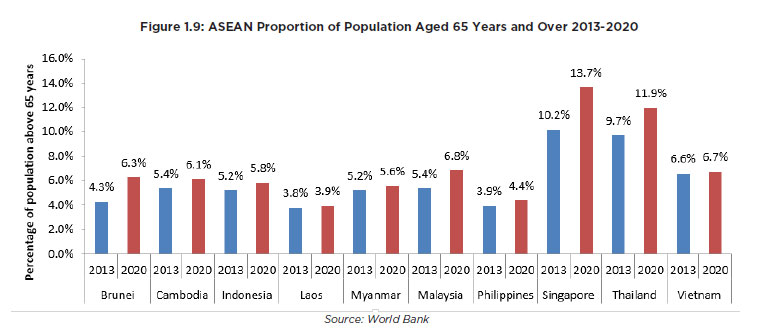

The aging society in ASEAN will place new demands on the healthcare systems with the CAGR trend of the above 65 year ago group being higher than other age groups.

As population aging trends show, six out of ten countries will have more than 6% of the population above 65 years of age by 2020, and Singapore and Thailand are especially affected. Healthcare services for the elderly is an issue that needs to be taken into consideration from home healthcare to adaptable senior living care consistent with Asian values.

4.6 The ASEAN Brand

Companies can pull their resources together to facilitate activities as an ASEAN company or initiative. Companies can segment themselves using an ASEAN branding instead of belonging to an individual country or Southeast Asian group. This will increase regional awareness as well as to view of the entire ASEAN market as a whole. This could be carried by companies operating in a few of the ASEAN nations. The government can create pioneering benefit policies to encourage private and public partnerships in the rebranding effort. The eHealth system in Vietnam if implemented with adaptability to communicate with the rest of ASEAN health networks be it private or public will see a united synchronised health management system.

5. POST LIFTING-THE-BARRIERS (LTB) ROUND TABLE CONSIDERATIONS

In the roundtable meeting on 14th May 2015, the future of ASEAN healthcare and steps towards its integration were discussed. Five suggestions were proposed:

- Mutual Recognition Agreement for human resource exchange.

- ASEAN Innovative Healthcare Council to address public and private healthcare development.

- More public and private partnerships to increase and promote healthy lifestyle.

- Healthcare companies to balance societal needs and needed profits by government assistance.

- Certification of insurance companies to set a level of healthcare quality across ASEAN.

1. Mutual Recognition Agreement for human resource exchange

For the Mutual Recognition Agreements for talents, lack of skilled labour is hindering economic growth, in hospital services as well as research and development. The roundtable participants believe the situation can be improved with talent exchange among countries such as the Philippines who are scarce with general practitioners but strong in specialists, can exchange with Malaysia which has many general practitioners, but lacking in specialists. Talent exchange backed by the medical council was suggested to expedite the flow of talent as opposed to individuals seeking opportunities in the other ASEAN nations. This also will help contribute to a people-centred AEC.

2. ASEAN Innovative Healthcare Council to address public and private healthcare development

The roundtable discussed on non-competitive innovations, and an ASEAN trademark that will strengthen public awareness and sense of ownership to ASEAN. Both public and private healthcare will need to innovate in terms of language barriers, as well as putting in funding and management as a collective. Quick opportunities exist in relabelling by-pass fundamental differences within ASEAN member states, focusing on conformed regulations established by the various product working groups. Learning lessons from neighbouring countries such as causes for inflationary healthcare costs can help other member countries to avoid following the same steps.

3. Public and Private Partnerships to increase and promote healthy lifestyle

The discussions focused on the promotion of healthy lifestyles, and shifting from treatment and reduction of government healthcare costs. The key components to increased accessibility and the betterment of functional health were attributed to four main components:-

Governance :

Government needs to push preventive healthcare. Sin tax for unhealthy products such as tobacco and alcohol and promotion for healthy lifestyle.

Health Financing :

Taxes from sin tax to aid in funding for non-communicable disease prevention and cure.

Health information system, medical technology and service delivery :

To aid in database synchronising patient information to aid administration of health across ASEAN.

4. Healthcare companies to balance societal needs and needed profits by government assistance.

The comparison between costs of seeking treatment in one country to the other differs by a huge margin. Many private hospitals groups in ASEAN are listed companies. Thus society and investors are expecting profits to deliver earnings to the shareholders. This will in turn affect the patient and costs for healthcare in the whole country. In the gist to raise the standards of healthcare, costs for healthcare subsequently increases. A right balance will need to be sought between standards and costs claimable by insurance to ensure the population are able to get appropriate treatment via affordable insurance policies. This is important as majority of the population with developed healthcare rely on insurance to fund their health expenditure.

5. Certification of insurance companies to set a level of healthcare quality across ASEAN.

As the year The insurance companies can certify hospitals, or groups of hospitals within ASEAN that achieve a set of credibility of quality of service. Currently there is an initiative to get insurance to have coverage over different regions under the health travel council. Having the ability for insurance policies to claim across ASEAN will allow patients to seek more affordable care, as well as take opportunity in countries where healthcare fees are regulated or capped.

Concluding Remarks

As the year end dateline of 2015 approaches, the ambitious ASEAN vision faces obstacles to reach its full potential. The development of policies in the healthcare sector has successfully made medical devices, pharmaceuticals and soon to be traditional medicines conformity goals throughout ASEAN. In view of the broad scope of collaboration required by each country, a coordinated approach using the first three LTB considerations as propel the ASEAN Innovative Healthcare Council in pushing the development of the ASEAN healthcare industry, which will provide the basis to achieve the vision of the ASEAN Economic Community Blueprint.

RELATED REPORTS

- ASEAN SHOULD FOCUS ON HEALTH TOURISM, ASEAN-WIDE HEALTH INSURANCE, AND TALENT MOBILITY

- LIFTING THE BARRIERS REPORT FOR ASEAN HEALTHCARE

- LIFTING-THE-BARRIERS REPORT 2013: HEALTHCARE